Last December two Democratic representatives, Rosa DeLauro

of Connecticut and Jan Schakowsky of Illinois, introduced a health care reform

bill called Medicare for America. At the time, it got relatively little

publicity, but now that it has been reintroduced as

H.R. 2452, it deserves a closer look.

Medicare for America (or M4Am, for short) is increasingly seen as a pragmatic option for Democrats

who want to stake out a slightly more centrist position than the party’s

progressive superstars. For those with low incomes and chronic illnesses, M4Am,

like Senator Bernie Sanders’ Medicare for All, would provide free first-dollar

coverage for a wide range of medical, dental, and vision services. Unlike the

Sanders plan, though, it would subject people with higher incomes and lower

medical expenses to income-based premiums and cost sharing.

Here are some of the key features of M4Am, followed by some

suggestions that could further improve its prospects for support from a broad

range of the political spectrum.

Medicare for America and Universal Catastrophic Coverage

Medicare for America belongs to a family of health reform plans

known generically as universal catastrophic coverage (UCC). The aim of UCC

is to protect everyone against financially ruinous medical expenses though full

first-dollar coverage for the poorest and sickest, while requiring income-based

cost-sharing from those who can afford it. UCC posits a robust role for the

government as a provider of social insurance where needed, while creating

adequate scope for market mechanisms where they have the best chance of

working.

Within the UCC family, specific plans differ in terms of

five key parameters: A low-income cutoff; deductibles; coinsurance and copays;

premiums; and specific services exempt from cost sharing. M4Am sets these

parameters as follows:

The low-income cutoff. H.R. 2452 sets the

low-income cutoff at 200 percent of the federal poverty level (FPL). (As of

2019, the FPL stands at $12,490 for an individual and $25,750 for a family of

four.) Households below the cutoff receive coverage free of all premiums and

out-of-pocket costs.

Cost sharing. As used here, the

term cost sharing refers to the combination of deductibles,

coinsurance, and copays that determine the amount that consumers pay out of

pocket for services provided. The 2018 version of M4Am included a small

deductible, but that has been dropped in H.R. 2452, which relies entirely on

coinsurance for cost sharing. The coinsurance rate is set at 20 percent, up to

an income-dependent out-of-pocket maximum. For households below 200 percent of

the poverty line, the maximum is zero. Above 600 percent, the maximum is $3,500

for an individual and $5,000 for a family. Between those limits, the

out-of-pocket maximum varies according to a linear sliding scale.

Coinsurance and deductibles each have their advantages.

People subject to deductibles get a stronger market signal to economize on

expenditures. On the other hand, for a given out-of-pocket maximum, coinsurance

extends over a broader range of spending, so the market signal, although

weaker, applies to more transactions. Studies show that both forms of cost

sharing sometimes lead consumers to forego appropriate, cost-effective care

rather than only avoiding care that is inappropriate or overpriced.

In practice, the amount of spending covered by the M4Am

coinsurance formula would depend on both the distribution of income and the

distribution of medical expenses among households. Using the U.S. distribution

of both variables, my rough estimate is that about 32 percent of all personal

medical transactions would be subject to coinsurance, assuming that no

transactions were exempt. With a coinsurance rate of 20 percent, that would

mean that cost-sharing payments by households would come to about 6.4 percent of

all health care spending.

Premiums. Premiums play an

important role in the financial model of M4Am. The amount of that each family

has to contribute toward premiums would vary with income, as follows:

- Each

year the Secretary of Health and Human Services would set a base

premium (my term, not used in the law as drafted). The base

premium would vary by family size but not by age, health status, or other

factors.

- For

households below 200 percent of FPL, the premium would be paid in full by

M4Am.

- For

households in the range of 200 to 600 percent of FPL, the premium would be

subsidized. The net premium (that is, the premium less

the subsidy) for families in this range would follow a linear scale

starting at zero for those at exactly 200 percent of FPL and rising either

to the base premium or 8 percent of income, whichever is smaller. Under

this formula, the premium is always below 8 percent of income for everyone

from 200 percent to 599 percent of FPL.

- For

households above 600 percent of FPL, the net premium would top out at 8

percent of income or the base premium, whichever is smaller.

H.R. 2452 is not very specific about how the Secretary would

set the base premium. It speaks of “community-rated premiums” which are set

“with respect to” the costs of services and administration and do not exceed 8

percent of income for any household. As nearly as I can determine, the

intention of M4Am sponsors is that the base premium should be set following

actuarial principles that would allow the base premium without subsidies plus

cost-sharing to cover the full cost of the program. Premium subsidies would be

paid from general revenue.

Exempted services. M4Am, like many other

programs, exempts certain services from cost-sharing. Preventive services are one important example, but

M4Am does not stop there. Other big-ticket items that would be provided free of

coinsurance include long-term services and supports; chronic disease services;

services for people with several classes of mental, behavioral, and

developmental disabilities; generic drugs and nongenerics where medically

necessary; pregnancy services; and emergency services. I am guessing that

altogether, more than half of all personal medical spending would be fully

exempt from cost sharing.

Financial provisions. The funds needed to

cover the costs of premium subsidies and cost-sharing exemptions would come in

part from reductions in spending on existing government programs such as

Medicaid, the Affordable Care Act (ACA), and the Children’s Health Insurance

Program (CHIP). In addition, the bill has several tax provisions, including

increased payroll taxes for high-income individuals and for firms that

terminate their employee health coverage; a repeal of the Trump tax cut; a 5

percent income tax surcharge on personal incomes over $500,000 per year, and

some other items. At some point, someone will need to do a careful financial

analysis of the program to see if these sources of funding are adequate,

insufficient, or more than adequate.

Critique and Suggestions

Health care systems around the world and proposals for

reforming the U.S. system vary in terms of the way payments for services are

shared between household and nonhousehold sources. The household share for the

current U.S. system is about 30 percent, not far above the OECD average of 28

percent. The sponsors of M4Am provide no explicit target, but it is clear they

intend to reduce the household share. My own back-of-the-envelope calculations

suggest that under M4Am, household payments in the form of premiums and

coinsurance fall to something like 20 to 25 percent of all personal medical

spending.

I cannot say whether 20 percent, 30 percent, or some other

number is optimal. Ultimately, the size of the household contribution is a

political decision that would be subject to negotiations as reform plans work

their way through Congress. Instead, I would like to focus on some technical

suggestions that could help M4Am meet its goals of making health care

affordable while asking those who can to pay their fair share, whatever a “fair

share” ultimately turns out to be.

Smoothing out the contribution schedules. M4Am

calls for household contributions in the form of income-based premiums and

coinsurance. However, the contribution schedules that it specifies have some

rather quirky properties that might be worth revisiting.

One quirk is that total contributions, including premiums

and cost-sharing, hit a maximum as a percentage of income at 600 percent of FPL

($74,940 for an individual or $154,500 for a family of four) and then decrease

significantly for upper-middle-class and wealthy households. That remains true even

if tax surcharges on high incomes are included along with premiums and

coinsurance.

Another quirk arises from the way that income and family

size interact as determinants of net premiums. For incomes above 200 percent of

FPL, but not very far above that level, large families face a lower maximum

contribution as a percentage of income than do individuals or smaller families.

However, for families with incomes above 600 percent of FPL or only a little

below that level, large families face a higher maximum burden.

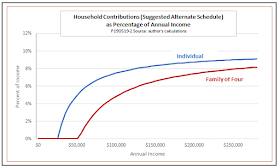

Both of these quirks can be seen in the following figure,

which shows total maximum household contributions as a percentage of income for

individuals and four-member families. For purposes of illustration, the figure

assumes base premiums at 120 percent of the 2019 level for ACA silver plans, as

given by the Kaiser Family Foundation’s Marketplace Calculator. Actual M4Am premiums

could be higher or lower, but the same general patterns would hold.

I do not know if the authors of M4Am specifically intend to

give a better deal to more affluent families than to those in the middle class,

or to favor larger families in some income ranges and individuals and smaller

families in others. Intentional or not, however, I do not find these features especially

attractive. Instead, I would suggest a simpler method that would apply

income-based contributions more uniformly.

My proposal would set the maximum contribution for all

families at a fixed percentage of eligible income, defined as

income in excess of the low-income threshold. The following figure gives

hypothetical schedules for individuals and four-person families. To keep the

numbers close to those used in H.R. 2452, the figure uses 200 percent of FPL as

the low-income threshold and sets the maximum household contribution rate at 10

percent, including both premiums and cost sharing:

These alternate schedules apply the principle of

income-based contributions uniformly to everyone with middle- and upper

incomes. They also ensure that larger families always pay less than smaller

ones at any given level of income.

Premiums vs. cost-sharing. Once the

overall schedule for household contributions is set, we can turn to the issue

of how the total should be divided between premiums and cost sharing. My rough

estimate is that the payment schedules proposed in H.R. 2452 would result in a

mix consisting of about 85 percent premiums and 15 percent cost sharing.

For a given total household contribution, higher premiums

and lower cost sharing tends to shift health care costs, within any income

group, away from those who are relatively sick toward those who are relatively

healthy. That, in itself, is not unreasonable — after all, such a shift is the

whole point of having health insurance in the first place. However, too great a

reliance on premiums combined with too little cost sharing has some

disadvantages.

One concern is that low cost-sharing requirements reduce the

range over which consumers have market incentives to shop carefully for health

care. A premium, once paid, is a sunk cost that has no effect on consumers’

decisions to lead a healthy lifestyle, to think twice about nonessential care,

or to shop for the best value rather than simply visiting the most convenient

provider. True, such incentives are not a cure-all, especially in a system that

is as lacking in market transparency and competition as ours is today. However,

any proposal that neglects market incentives, or reduces them to a token role,

is likely to lose the support of an important segment of the community of

health care reformers.

A second concern is that the greater the reliance on

premiums, the more acute is the issue of what to do about people who do not pay

them. If young, healthy people fail to pay, premiums would rise for those who

did participate.

H.R. 2452 leaves it to the HHS Secretary to set appropriate

rules concerning nonpayment. Quite possibly those rules might resemble current

Medicare rules, which allow disenrollment for nonpayment and impose penalty

premium rates on people who later apply for re-enrollment.

Although the existing rules appear to work tolerably well,

the problems of nonpayment, disenrollment, and adverse selection might well be

more serious under M4Am than they are under traditional Medicare. Partly that

is because M4Am premiums are likely to be higher, especially for young,

healthy, high-income professionals. Penalties would have to be quite steep to

keep nonpayment to an acceptable level.

Also, changes in enrollment status would be more frequent

under M4Am than they are for traditional Medicare. Under the current system,

enrollment in Medicare, for most people, is a once-in-a-lifetime experience.

Under M4Am, many kinds of life events could induce moves onto or off of the

program. For example, divorce, death of a spouse, or leaving one’s parents’

household could require a person formerly covered by a family plan to establish

an individual policy. For those who remain on employer-sponsored insurance,

loss or change of a job could trigger enrollment or re-enrollment in M4Am.

There would also be opportunities to move back and forth between M4Am and a

proposed Medicare Advantage for America plan, analogous to existing Medicare

Advantage plans. Keeping track of who owed what and determining whether lapses

in premium payments were due to inadvertence or willful noncompliance would be

a major challenge.

Both to enhance incentives for careful shopping and to

reduce incentives for nonpayment, I would suggest shifting the revenue mix of

M4Am toward lower premiums and higher cost sharing. Without raising the maximum

household contribution, that could be done by lowering the base premium while

raising the range of spending subject to coinsurance, or by reintroducing a

modest deductible (dropped from the 2018 version of M4Am).

Prohibition of private contracting. Another

distinctive feature of Medicare for America is an outright ban on private

contracting. The relevant language in H.R. 2452 reads as follows:

NO PRIVATE CONTRACTING. — A health care provider or health care institution are prohibited from entering into a private contract with an individual enrolled under Medicare for America for any item or service coverable under Medicare for America.

An official summary of M4Am issued by Rep.

DeLauro’s office uses somewhat different language in describing the

prohibition:

Medicare for America would fix the current two-tiered healthcare system by banning private contracting. The wealthy and well-connected currently use private contracting to pay for care from providers who do not accept health insurance and demand to be paid completely out of pocket.

Comparing the two versions leaves it unclear whether all

private contracting is to be prohibited, or only private contracting with

individuals enrolled directly in the basic M4Am plan. Is private contracting

prohibited for people who opt out of M4Am because they are enrolled in other

qualified coverage, such as employer-sponsored insurance, Medicare Advantage

for America, or one of the smaller ongoing government programs such as TRICARE

or the Indian Health Service? The language of the bill would appear to say

contracting would be prohibited only for those in the basic version while that

of the summary implies that the prohibition applies everywhere.

A related issue also needs attention: On the face of it,

once M4Am came fully into force, insurance coverage of some kind would be

universal. H.R. 2453 specifies that people would be permitted to opt out only

if they enroll in other qualified coverage. In practice, however, whether or

not coverage was truly universal would also depend on whether people would be

disenrolled for nonpayment of premiums. If yes, that would make it possible to

opt out of M4Am through the back door, via nonpayment, even without having

other eligible coverage. Would providers be allowed to contract with people who

had been disenrolled, including those whose disenrollment was intentional? If

so, then a two-tier system could very well survive.

In my view, the outright ban on private contracting is

unworkable, unnecessary, and undesirable. Instead, I would suggest something

like the less restrictive (and more clearly stated) restrictions on contracting

found in Section 303 of the Sanders’ Medicare for All bill. That language would be sufficient to

prohibit the two most obvious abuses:

- It

would outlaw “balance billing,” in which a provider takes the fee offered

by government insurance, then bills the patient an additional amount for

the same service.

- It

would prohibit mixing public and private contracting by a single provider.

Among other things, that would eliminate the worry that practitioners with

dual practices might rush through a lot of M4Am patients and then take

special care with those on private contracts.

As I read it, though, the Sanders language would not

prohibit concierge practices that dealt only with private patients and billed

the full cost of services to those patients or their private insurers. Although

many supporters of single-payer health care do not like private practices of

this type, there are good, pragmatic reasons to permit them.

One is that allowing a small private sector would reduce

costs of the public program by reducing demand for its services. Anything that

reduced the cost of the program without degrading the quality of services,

would, in turn, improve its political prospects. The small number of households

likely to patronize concierge practices would in no way be free riders on the

rest of those served by M4Am. On the contrary. Although they would not pay

premiums, if concierge clients had high incomes (as would presumably be the

case for most of them), they would still be subject to payroll tax and income

tax surcharges. Meanwhile, they would take nothing from M4Am.

Second, the very existence of a small private sector would

help to alleviate one of the greatest sources of resistance to universal or

near-universal government health care: the fear of long waiting periods. The

experience of the British National Health Service provides some lessons in that

regard. In the years before Tony Blair became prime minister of the U.K.,

waiting times in the National Health Service grew alarmingly for procedures

like hip replacements. As waits grew longer, the British private sector,

normally a small niche market, began to grow. That growth, in turn, acted as a

spur to reforms by the Blair government that significantly shortened waiting

times. Since then, the private sector has again become smaller.

Conclusions

Medicare for America stands as a welcome addition to the

growing number of reform proposals now on the table. It its own way, it adheres

to the principles that I have repeatedly urged in previous writings on the

reform of health care policy:

- Affordable

access to quality care for everyone.

- Freedom

from the threat of financially ruinous medical bills.

- Full

first-dollar coverage for the very poor and the very sick.

- An

expectation that those who can afford it will pay a fair share of the cost

of their own care.

- A role

for government as a provider of social insurance matched by ample scope

for market mechanisms where they work best.

Much more could be said about Medicare for America. For

example, I find many of its ideas about transition, the role of

employer-sponsored insurance, financing provisions, and other aspects of reform

to be well founded. Although there is not room to discuss them here, I have

many comments and suggestions regarding those areas, too. I look forward to

seeing further development of M4Am as it moves though the legislative process.

No comments:

Post a Comment